Industry Shift & Current Auctions

* Note: In Part I, we received a few comments about the spelling of ‘whisky’. Scotch Whisky and Japanese Whisky are both properly spelled with no ‘e’. American and Irish whiskey have the ‘e’. For the purposes of this series we are discussing the higher-end of the market where most of the volume, in terms of sales, come from Scotch and Japanese Whisky.

In Part II, we are taking a look more specifically at what is changing in the market, as well as the most recent auctions. The industry is seeing a monumental shift, forced upon us by the virus, that has affected most channels of the beverages industry.

- Restaurants are selling bottles of wine and mixed drinks, often of high value, at prevailing market prices and in some cases only selling wine as a makeshift retailer to keep things afloat the best they can. I spoke to the owner of a NY restaurant that sold 250 to-go margaritas in a single day! As states ease restrictions on on-premise sales, restaurants can use a very valuable asset to bring in much-needed cash.

- Online sales have skyrocketed, especially in late March with 55% increases in general orders and double and triple volume with online delivery services like Drizly. Sales have recently smoothed out, but they’re still up on a month-over-month basis.

- Small producers in Napa that focus on DtC and restaurants are quickly working on ways to bolster online sales with outreach to current and past club members, increased social media presence and virtual tastings. More well-established producers are seeing 200% to 500% increases in sales.

- Virtual tastings are becoming a big part of wine interaction, but not all of them are successful. Execution can be tough, due to the logistical challenges of getting all participants wine in a timely fashion, creating a personal connection and dealing with technical problems that can pop up on online conference tools.

The industry will see permanent shifts after this crisis is over. It remains to be seen exactly what the effect will be in the long run and what opportunities arise.

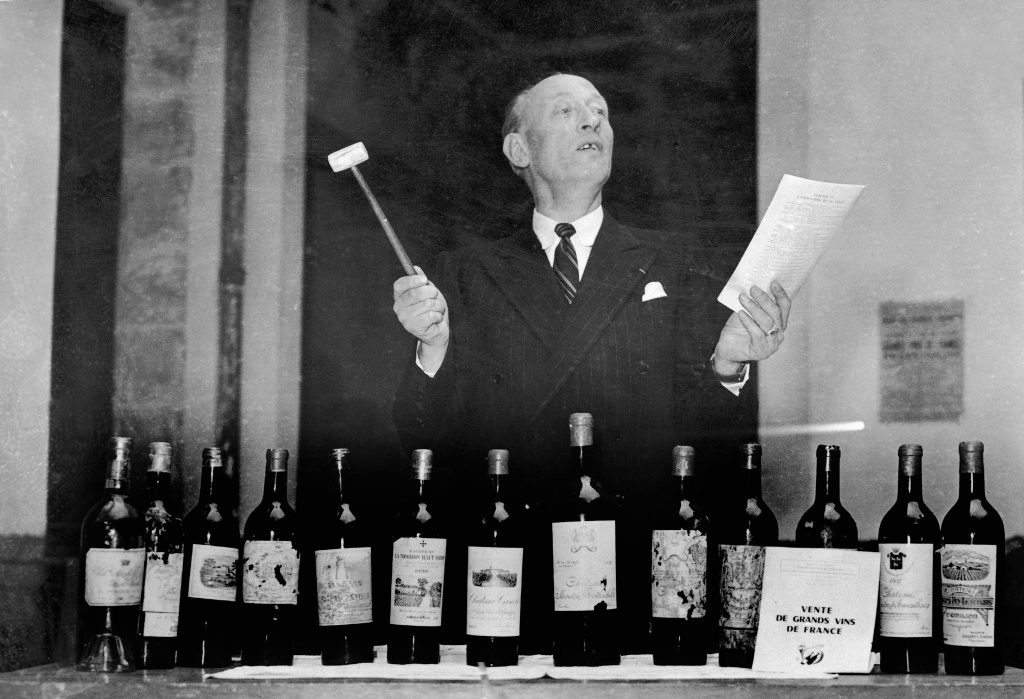

There have been several auctions since April 15th in both wine and whiskey, which we can review to see if there are any cracks in the armor during the pandemic.

HDH Wine – Celebration of Burgundy – April 7 & 18 – pre-auction estimates of $4.8 to 7.3 million showed the increased uncertainty with such a wide range. The sale indicated that the market is still strong. Burgundy continues to dominate the wine world, with $7.6 million in sales, a 100% sell-through rate, and 62% of lots selling at or above the high estimate. Top producers such as DRC, Leroy, Roumier, and Rousseau did very well. White Burgundy did well, too, with 10 of the 15 D’Auvenay lots selling above the high estimate.

Sothebys – The Macallan Fine & Rare Collection – April 19 – pre-auction estimates of $1.39 to $1.49 million, with total sales of $1.46 million, showed the resilience of the high-end market. This sale had only 54 total lots, comprised mainly of Macallan Fine & Rare, with 32 (or almost 60%) selling above $20,000. The top lot was The Bowmore Trilogy Collection that sold for $161,000. The sell-through rate was a relatively low 83%, but those lots that did sell earned a good 40% above high estimates, showing strong, but very deliberate purchasing in this market. An apple-to-apples comparison with Sothebys’ March sale shows there has been very little drop off in the market: in March, a bottle of 70-year-old Macallan Genesis sold for $105,800; in April, another bottle of the same liquid sold for $99,200, indicating stability.

Whisky Auctioneer – The Perfect Collection Part 2 – This is the second part of the Richard Gooding collection and is comprised of 1,900 total bottles, including a Macallan Fine & Rare 60-year-old 1926 that sold at Sothebys for $1.9 million in October. The auction was scheduled to end on April 20th, but there were two cyber attacks on the site and the auction has been postponed indefinitely. Before the final attack, the 60-year-old Macallan was hovering at $720,000 with 22 total bids on April 21st.

Not all sales have been quite as rosy. A March 19 HDH Whisky auction showed some weakness: the majority of lots sold at or below the low estimate, including 21 of the 28 Scotch Whisky lots with top end estimates of $2,000. Some segments performed well, with American Bourbon Pappy Van Winkle selling all 117 lots above the low estimate. In fairness, this auction was held the same week the US declared a national emergency, the President advised no groups of more than 10 could gather, and France imposed a national lockdown. The recent HDH Burgundy sale illustrates that buyers have regained confidence or at least accepted the ‘new normal’ and are back in a buying mood.

In Part III, we will explore what is next in the short term and post the pandemic.